You have most likely heard traders talk about shorting the market or buying on margin to make massive profits. This can be very confusing if you have not heard of these terms before or if you don’t know anything about leverage trading. In this article, I will explain what is margin trading and give examples of how it works.

Table of Contents

What is leverage in trading?

In a simple explanation, buying on margin refers to margin trading (also known as leverage trading), which is just a method that an investor can use to buy or sell financial trading assets such as stocks or cryptocurrencies. To place a buy or sell order with the method of margin trading, you will have to use borrowed funds provided by a third party.

In comparison to regular trading, margin trading will allow you to access a greater amount of capital (the borrowed funds), permitting you to leverage your position. Margin trading amplifies your trading position. Which results in larger profits on successful trades. This ability to magnify trading results is one of the most common reasons why leverage trading is popular.

The third-party that provides borrowed funds when leverage trading in traditional markets is usually a bank or an investment broker. This is different when it comes to trading on margin with cryptocurrencies. Borrowed funds are often provided by retail investors or other traders. These individuals will earn interest on the borrowed funds based on market demand. Though less common, you may also find cryptocurrency exchanges that will provide margin funds to their users.

Additionally, traders and investors encourage margin trading as it allows you to short the market (bet against the market price going up).

Buying On Margin: How Does It Work?

When you initiate a margin trade, you are required to commit a percentage of the total order value. This initial investment is known as the margin, and the concept of leverage is closely related to the margin. Margin trading accounts are used to create leveraged trading. The leverage depicts the ratio of borrowed funds to the margin. For example, to open a $1,000 trade at a leverage of 5:1, a trader would need to commit $200 (1/5*$1000) of their capital.

When trading on margin, you will find that different trading platforms and markets offer a distinct set of rules and leverage rates. In traditional markets such as the stock market, a typical ratio would be 2:1, while futures contracts would often be traded at a leverage of 15:1.

When it comes to Forex brokerages, trading on margin is frequently leveraged at a 50:1 ratio, but you will also find leverage ratios of 100:1 and 200:1 also used in some cases.

In regards to crypto margin trading, the leverage ratios are typically ranging from 2:1 to 100:1, and you will find that the cryptocurrency trading community often uses the ‘X terminology to define ratios (2x, 5x, 10x, 50x, and so forth). So for example, a 2:1 leverage ratio would be represented by 2x, and a 10:1 ratio would be represented by 10x.

Leverage Trading: Long & Short Positions

Investors can open both long and short positions when trading on margin. A long position reflects an assumption that the price of an asset will go up, while a short position reflects that the price of the asset will go down. One thing to note is that whilst a margin position is open, the trader’s assets act as collateral for the borrowed funds. Investors or traders must understand this as most brokerages reserve the right to force the sale of these (your) assets in a case whereby the market moves against the trader’s position (above or below a certain threshold). Usually, you will be notified before you place your order that your assets will be liquidated if the market price goes above or below a certain threshold.

For example, if a trader opens a long leveraged position, they will be margin called when the price drops significantly and reaches above or below a certain threshold. When a margin call is issued, traders and investors are required to deposit more funds into their margin trading account to reach the minimum margin requirements. If the trader fails to do so, their holdings will be automatically liquidated to cover their losses. This typically occurs when the total value of all of the equities in a margin trading account, also known as the liquidation margin, drops below the total margin requirements of that particular broker or exchange.

Margin Trading Advantages and Disadvantages

The fact that Margin Trading can result in larger profits due to the greater relative value of your trading position is the most obvious advantage of margin trading. Another advantage is that trading on margin allows you to short the market (bet against the market i.e placing a position against the market price going up).

Investors can also use margin trading for diversification, as they can open several positions with relatively small amounts of investment capital. Finally, opening a margin trading account may make it easier for you as a trader to open positions quickly without having to shift large sums of money to your trading account.

On the downside, the most obvious disadvantage of trading on margin is the increase in your probable losses the same way that margin trading can increase your probable gains. With margin trading, it is possible to have losses that exceed your initial trade investment hence why it is considered a high-risk trading method. A slight drop in the market price may cause substantial losses for traders depending on the amount of leverage involved in the trade. For this reason, it is very important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders. It is recommended that you have a good understanding of technical analysis before attempting to margin trade.

Leverage Trading Crypto: Can You Short Crypto?

Yes! It is possible to short crypto via margin trading (leverage trading), however it is inherently riskier than regular spot trading. When it comes to margin trading crypto, the risks are even greater due to the high volatility levels in cryptocurrency markets. Investors that choose to margin trade cryptocurrencies should be very careful and cautious. Though hedging and risk management strategies may come in handy, I categorise margin trading crypto as certainly not suitable for newbies or beginners.

The ability to perform technical analysis on a chart, identify trends, and determine entry and exit points does not eliminate the risks involved with margin trading crypto. However, these skills may help one to better anticipate risks and trade more effectively. Therefore, I recommend that investors develop a keen understanding of technical analysis and acquire extensive spot trading experience before leveraging their cryptocurrency trades.

Binance Exchange: Margin Trading Crypto

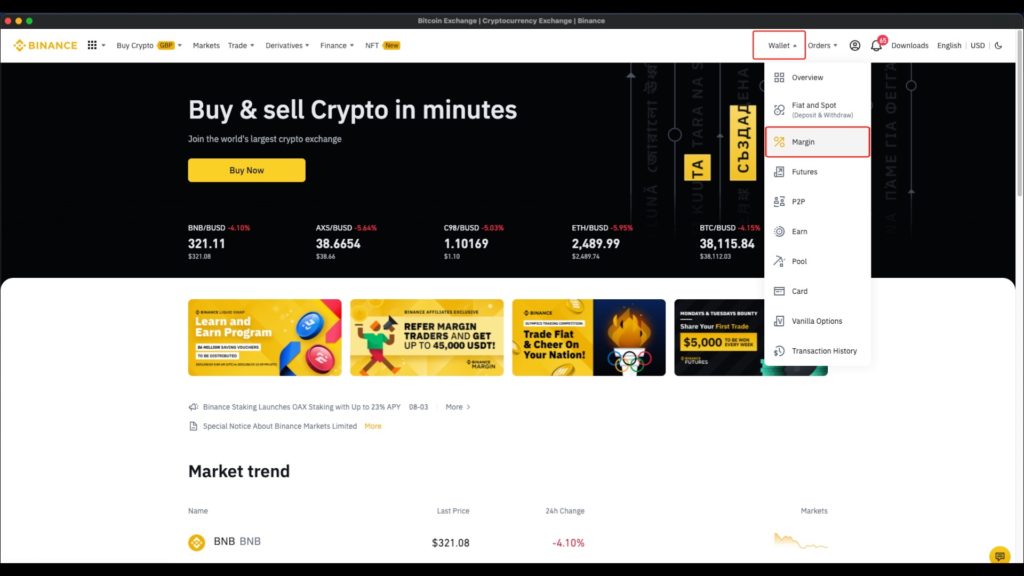

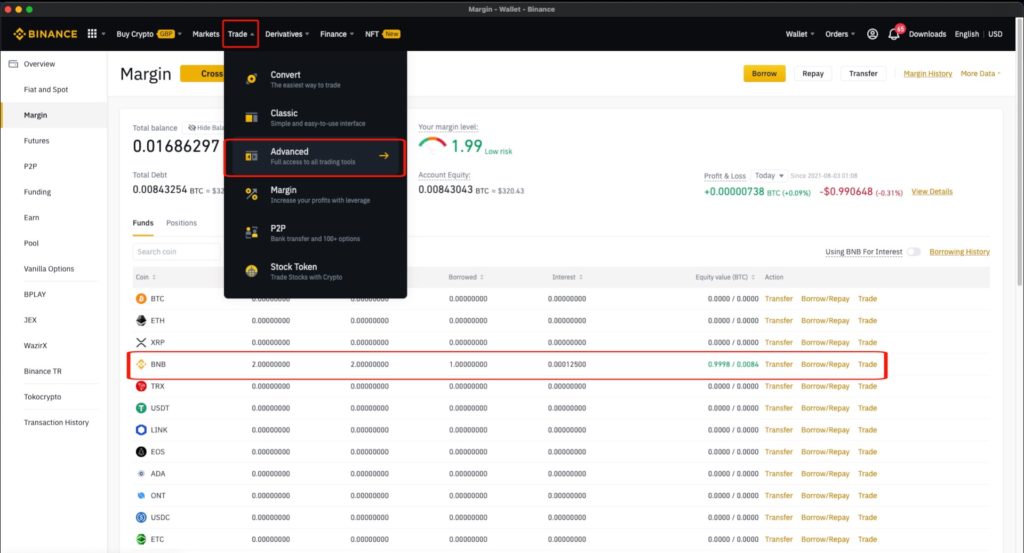

I use Binance for margin trading cryptocurrency. If you don’t have a Binance account, you can register for one here. To buy on margin, you will need to have funds in your Binance account. Click here to watch a Binance video tutorial if you require assistance. Once you have funds on Binance, move your mouse to the top right corner and hover over “Wallet“. A dropdown will open, click on “Margin“to go to your margin account dashboard.

Here you will be able to see your margin trading account balances. Ensure that you have verified your identity before you continue as KYC (identity verification) is mandatory for you to be able to margin trade on Binance. You are also required to enable 2FA before you can start trading on margin, additionally make sure that your country is not blacklisted.

Next, you will be reminded about the risks involved with margin trading. Take time to read and understand the risks involved and proceed by selecting “Open Margin Account”.

Please ensure that you carefully read and understand the Binance margin trading account agreement. Once you have reviewed the agreement, tick the box and select “I understand” if you agree to the Terms and Conditions.

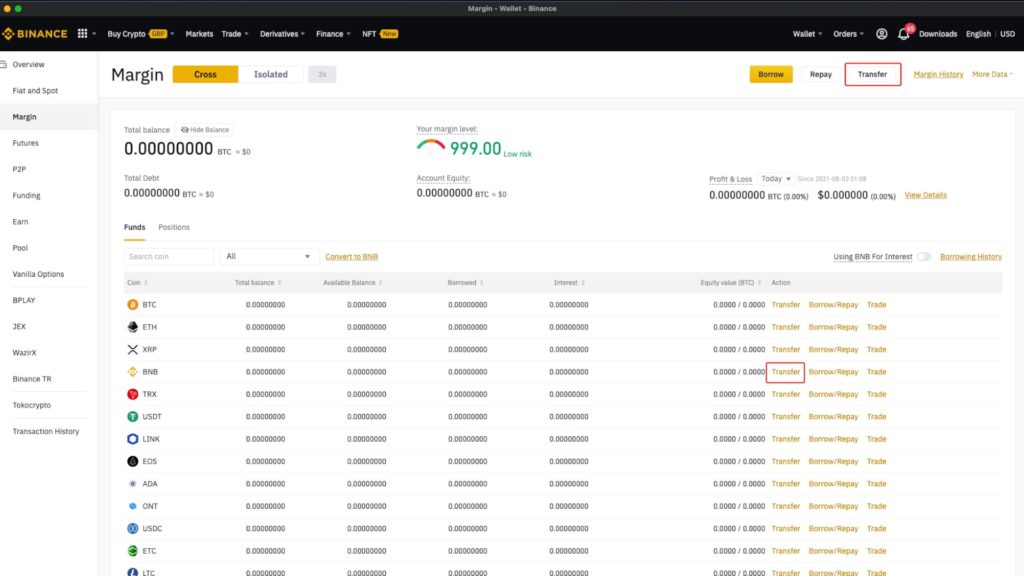

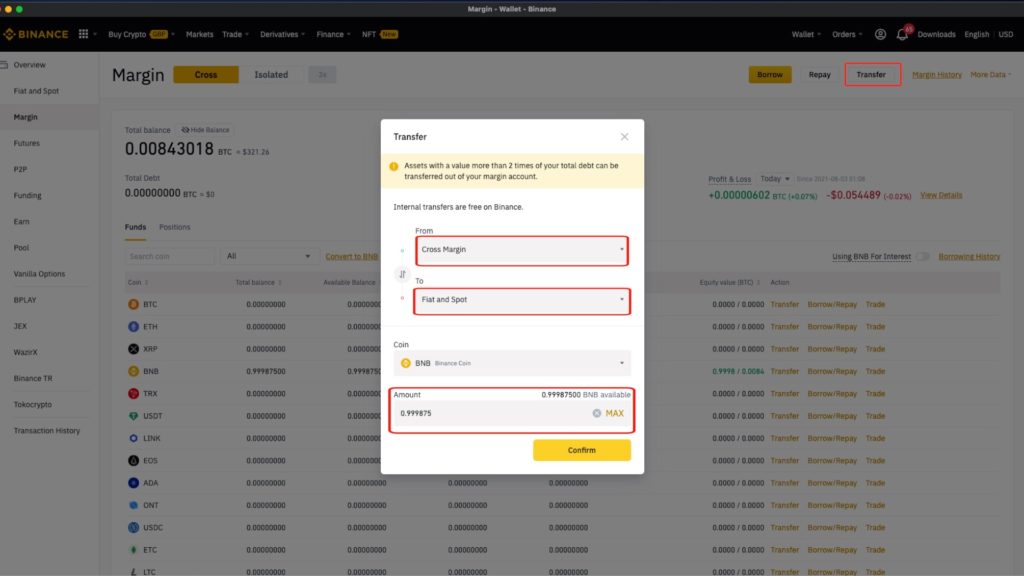

Transfer funds to your Binance Cross Margin Trading Account

Once your crypto margin trading account is opened and activated, transfer your funds from your regular Binance Wallet to your Margin Trading Wallet. This can be done by either searching or locating the crypto that you would like to margin trade, and selecting the “Transfer” button on the right side of the page.

Alternatively, you can click the “Transfer” button on the top right side of the page, select the wallet you would like to transfer funds from i.e Fiat and Spot. Select the wallet you would like to transfer funds to i.e Cross Margin. Then select the coin that you would like to transfer, input the amount you would like to transfer, and hit “Confirm” button to move the funds from your Fiat and Spot Wallet to your Cross Margin Wallet. See images below for reference or click here to watch a Binance video tutorial if you require assistance.

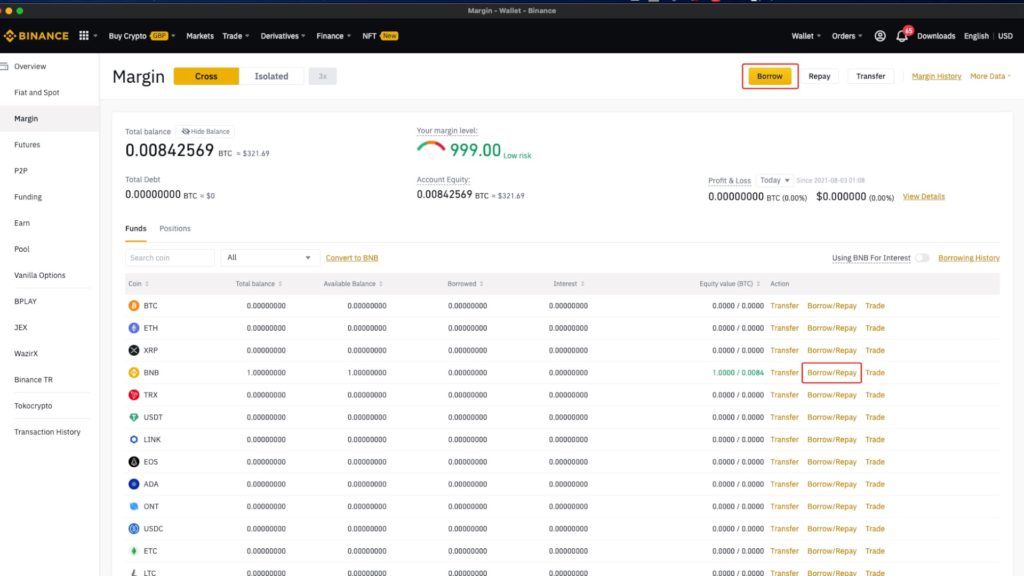

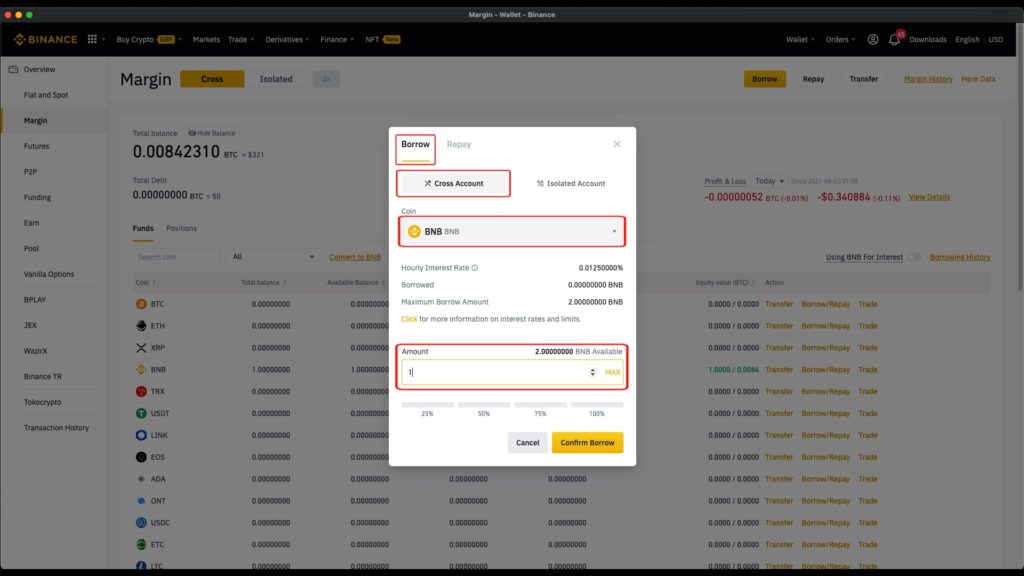

How to Borrow funds to Margin Trade with on Binance

Now that your coins (digital currency coins) are in your Binance margin trading wallet, you can use them as collateral to borrow funds. The amount in funds you can borrow is determined by your Binance margin wallet balance. Following a fixed rate of 3:1 (3X), you would be able to borrow up to twice as much as your balance. For example, if you had 1 BTC, you can borrow up to 2 BTC.

To borrow funds, simply select the coin you would like to borrow, input the amount you want to borrow, and click “Confirm borrow.” This will result in your Binance margin trading wallet being credited with the coin that you chose to borrow. You will be able to start trading on margin with the borrowed funds while having a debt of the borrowed funds plus the interest rate. Please note that the interest rate on Binance is updated every 1 hour. All available margin trading pairs and rates are available on Binance’s Margin Fee page.

Additionally, to check the status of your margin account, navigate to your wallet balance page and select the “Margin tab.

What is the Margin Level?

Your margin level will be on the right side of your screen. This shows you the level of risk according to borrowed funds (total debt) and collateral funds (account equity) that are held in your margin trading account.

Market movements determine your risk level, therefore if the market price moves against your prediction, you face the risk of your crypto assets being liquidated. Binance will also charge you extra fees if you get liquidated.

The margin level is calculated using the formula below:

Margin Level = Total Asset Value / (Total Borrowed + Total Accrued Interest)

A Margin Call will be executed if your margin level drops to or below 1.3. A margin call is a notification reminder for you to increase your collateral by depositing more funds. You can also increase your margin level by reducing your loan balance. To do this, all you have to do is repay the funds that you borrowed.

Your assets will be automatically liquidated if your margin level drops to 1.1. This means that Binance will sell all your crypto assets (funds) at market price to repay the funds that you borrowed.

To get detailed information regarding your current positions, click the “Positions” button. You can also change the values from USD to USDT by selecting “USDT Benchmark” on the right side.

How To Short Crypto: Leverage Trading Crypto On Binance

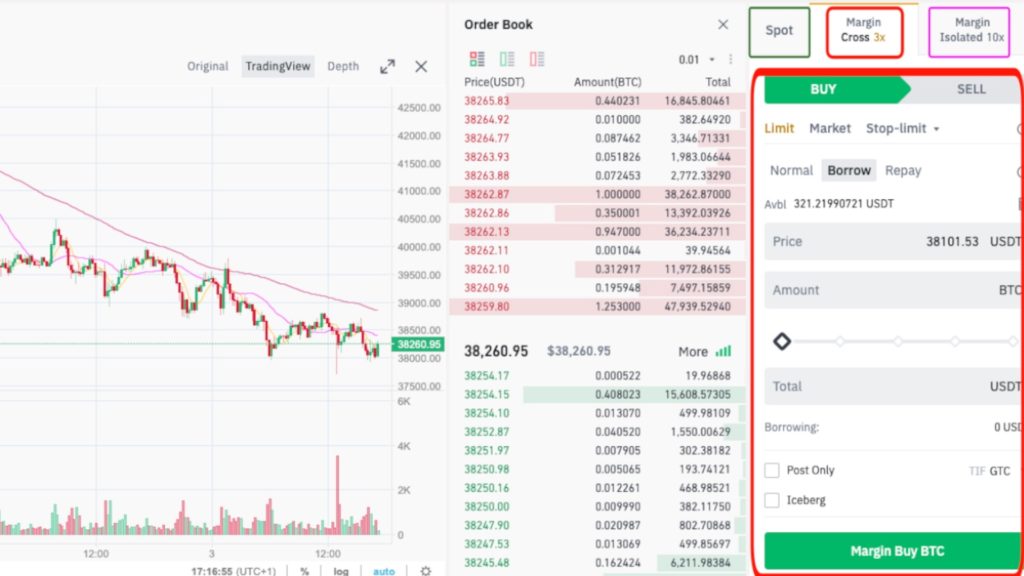

Go to the Exchange page and select the “Margin” tab to use your borrowed funds to trade. You will be able to execute trades as normal using Limit, Market, Stop-Limit, and OCO orders.

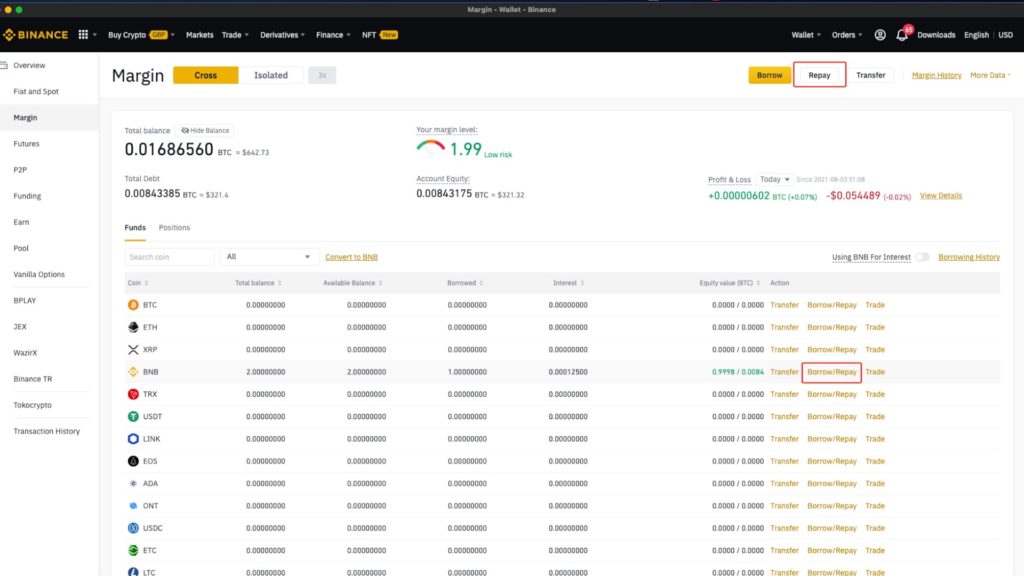

How to repay your debt (borrowed funds)

To repay your borrowed funds, click the “Borrow/Repay” button and select the “Repay” tab.

You will be required to pay the sum of your total borrowed funds plus the interest charged. Ensure that you have the required funds in your wallet to pay back both your debt plus interest charged before proceeding. Select the crypto coin and amount that you would like to repay and click “confirm repayment”. Note that you can only make a repayment using the same crypto coin that you borrowed.

Binance Margin Switch Button

Binance has a switch button next to your balances on their margin interface. You can switch between asset mode (normal orders) and margin mode (margin orders) using the switch button. If you switch to margin mode and are trading with a leverage ratio of 3X, if you hold 10 BNB in your Margin account, you can sell up to a total amount of 30 BNB.

The Binance interface will change slightly once you have switched to margin mode. You will notice that the regular “Sell” button will change to “Margin Sell”.

Let’s assume that you wanted to “Margin Sell” 20 BNB, the exchange will automatically borrow 7 BNB on your behalf to execute the trade. Remember that your actual balance is 10 BNB and you are margin trading at a ratio of 3:1 (3X).

The purpose of the switch button is to enable users to quickly borrow funds when opening new margin positions. However, the borrowed funds (plus interest) will have to be paid back manually afterward.

Transferring funds from the Margin Wallet to a regular Binance Wallet

To transfer your funds back from the Margin Wallet to your regular Binance wallet, click “Transfer” and use the switch button in between the two wallets to change the direction of the transfer. Select the crypto coin that you want to transfer, input the amount and click “Confirm transfer.”

No fees are charged to move funds from one wallet to another within the Binance platform. However, if you are holding any borrowed crypto coins, your risk level will increase as the funds in your Margin Wallet decrease. Keep in mind that your assets will be liquidated if your risk level gets too high. Therefore, make sure that you have understood how margin trading works before using it.